When Future Historians Write About the Fall of American Economic Power, Will Trump Be the Turning Point?

Under Trump, tax giveaways to the wealthy and soaring debt replaced economic stability and sacrificed the nation’s future for short-term political gain…

America’s economic system has never been fair or perfect, but for more than a century it rested on basic guardrails that kept instability in check and allowed us to fight for progress and win. Those guardrails are now being stripped away by policies that favor wealth and power over accountability and long-term stability.

For over a hundred years, the United States has been the cornerstone of international economic stability. The independence of our central bank (the “Fed”) has been a part of it, as has the strength of the dollar, which comes about in large part because the rest of the world relies on our currency as the default for international trade.

And now Trump and the GOP are threatening it all.

Trump has added $2 trillion to our national debt in the past 12 months, and he’s on course to do it again (or worse) this year. While our entire GDP — the entirety of all goods and services produced in America every year — is roughly $31.1 trillion, our national debt stands at $38.4 trillion.

Fed Chairman Jerome Powell pointed out yesterday:

“Right now we’re running a very large deficit at essentially full employment and so the fiscal picture needs to be addressed, and it’s not really being addressed,” adding, “the path is unsustainable and the sooner we work on it, the better.”

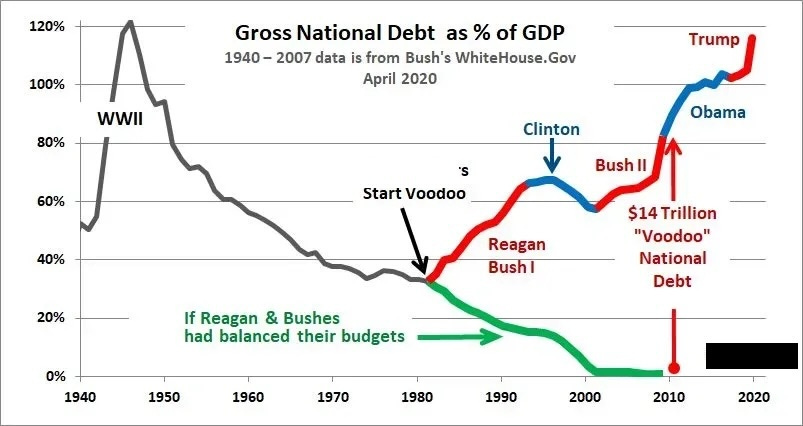

When Ronald Reagan came into office in 1981, our national debt was less than one trillion dollars, because every president from FDR to Truman to Eisenhower to Kennedy to Johnson to Nixon to Ford to Carter had worked to pay down the roughly 140% of GDP debt we ran up fighting World War II.

Across those same presidencies, America had also built a broad and strong social safety net for its citizens, primarily through the New Deal and Great Society programs. And Republicans hated it all, particularly because it’d been paid for with a 74% to 91% income tax on billionaires and a 50% income tax on corporate profits.

They were desperate to find a way to force Democrats to gut their own “Santa” social welfare programs, so, Republicans reasoned, if they just cut taxes on rich people and then ran the debt up hard and fast enough it would freak out Democrats and force them to dial back social spending.

They called it their “Two Santas” strategy, which I detail here, and over the course of the Reagan, Bush, and Trump tax cuts and two illegal wars, four Republican presidents managed to add over $37 trillion to our national debt.

The grimmest consequence of this is that we’re spending $1.2 trillion every year on interest payments on our national debt. That’s money that could otherwise have gone to create a national healthcare system, provide free college education, or help people buy their first homes but, instead, is going to payments to wealthy investors here and abroad who hold US Treasuries.

Up until recently, we were able to pull this off because the US Dollar has been the world’s reserve currency for the better part of a century. All sorts of international transactions (especially oil) are denominated in dollars, so there’s a huge worldwide demand for our currency because you can’t trade without them; that keeps the dollar’s value strong and lets us borrow at what would otherwise be absurdly low rates.

That, in turn, is essentially a subsidy for Americans of all stripes: lower mortgage rates, lower car loan rates, easier credit, and US-based companies can more easily finance growth and new product development.

It also gives our government more power on the international stage because we control the dollars everybody must use, so we can exploit that leverage to seize other countries’ dollar-denominated assets, enforce embargos, and freeze economic activity.

But twice in the past twelve months the value of the dollar has taken a huge hit, in both cases because the world freaked out at Trump’s insanity and started to sell dollars.

The first was in April of last year (a 6% drop in value) when Trump announced his bizarre worldwide tariffs; the second was last week when he went to Davos and blithered through a semi-coherent speech that left international leaders wondering about his sanity, his judgement, and his reliability. And, by inference, the judgment and reliability of the United States itself.

Trump’s own economic illiteracy and impulse-driven tariff policies, in other words, have damaged the value of our currency and may have put the status of the dollar as the world’s reserve currency at risk.

The most visible consequence of this collapse in the dollar’s value are spikes in the prices of gold (now over $5000/ounce, up from $1,077 in 2015) and silver, and how much more expensive foreign travel has become. Three years ago, the euro was at parity with the dollar (one dollar buys one euro), but today a dollar only buys €0.84 (84 cents).

As the dollar drops in value, that’s ultimately reflected in everything imported becoming more expensive (which drives inflation), although it does help companies that export things as it makes their goods and services cheaper.

The big impact, though, could come if international investors and other countries conclude it’s unlikely that the US will be able to repay our debts.

Ever since the Bush Crash of 2008 revealed how deregulation had corrupted our banking system, foreign investors holdings of US debt have steadily declined.

For the rest of the world to have “full faith and confidence” in the US and our currency, they must be convinced we operate with economic transparency and consistently abide by the rule of law.

Trump’s willy-nilly tariffs, often used to extort other nations into giving his family a new hotel or golf course, his constant lies on the international stage about everything from renewable energy to our “right” to invade a foreign country and capture its leader, to his killing fishermen off the coast of Venezuela and his current threats against Iran, all argue against trusting us.

Trump’s already destroyed our soft power by gutting USAID, ruined our relationships with our allies by embracing Putin and trash-talking NATO and the EU, and now is shaking the confidence of our remaining democratic allies by imposing police-state tactics on Blue cities.

The BRICS (Brazil, Russia, India, China, South Africa) countries are on the move, with Egypt, Ethiopia, Indonesia, Iran, and the UAE having joined recently in an agreement to use their alternative currencies instead of dollars. China’s Cross-Border Interbank Payment System (CIPS) is now also challenging our SWIFT system, and South Africa and Brazil are the most recent countries to integrate it into their own financial systems. They’re using the real and the yuan to trade things like soybeans, going entirely around the dollar.

India and the UAE are now trading in rupees and the dirham, and China is using yuan to buy natural gas from the UAE. China has almost entirely abandoned the dollar for their trade with Russia, the UAE, and Iran. Like South Africa, Brazil has increasingly been using the real and the yuan to settle bilateral trade with China, bypassing the US dollar.

Thus, in recent years, alternatives to the greenback are gaining traction. Even Trump’s good buddy Milei in Argentina is now trading with China in yuan instead of dollars.

We still have enormous momentum and a collapse of the dollar or the international system based on it is unlikely to happen in the near term, but if Trump continues to badger our Federal Reserve or appoints a toady to its chair, and continues with his erratic, illegal, and unconstitutional behavior here and abroad, there’s a good chance that a concerted international effort to de-dollarize will pick up even more steam than it already has.

Economic collapse isn’t inevitable, but it becomes more likely when demagogues choose inequality, debt, and instability over responsibility and shared prosperity.

Whether this era is remembered as a turning point or just a warning from our Fed chief will depend on whether we ignore those choices Republicans have made for 45 years, or if we finally confront and reverse them.

Hang on, keep your eyes open, and follow these trends. Forewarned is forearmed.

Louise’s Daily Song: “When the Bill Comes Due”

The song that was inspired by this article is here.

My reading this article as an audio podcast is here.

My newest book, The Last American President: A Broken Man, a Corrupt Party, and a World on the Brink is now available in bookstores nationwide.

You can follow me on Blue Sky here: https://bsky.app/profile/thomhartmann.bsky.social

The fall of economic power, bankrupting of America is the only thing that is going to save us and democracy.

Trump's superpower is American consumption, that consumption is powered by debt, all debt, public and private, it is why the worlds leaders come crawling on their knees when Trump says tariffs. It is why the Secretary General of NATO, Mark Rutte, met with Trump and caved on Greenland. It is why Trump ignores the Constitution and law and is dragging us into an irreversible fascist state..

Trump is using the money that our consumption generates to create an authoritarian rule, and make himself King of the World.

Don't diminish his Board of Peace as an attempt to supplant the UN, it is only a baby step, he has three more years to finish the job on America and the world. look what he has done in just 12 months.

Unfortunately, these people only care about their bank accounts of today, not what history says about them. And right now, this regime is writing the history books to flatter and/or lie about themselves because of their fragile 'masculinity', evidently.