Why Homelessness Stalks America Like the Grim Reaper

Both homelessness & inflation are the result of America allowing housing to become a commodity that can be traded & speculated in by financial markets & overseas investors...

Back in 1967, a friend of mine and I hitchhiked from East Lansing, Michigan to San Francisco to spend the summer in Haight-Ashbury. One ride dropped us off in Sparks, Nevada, and within minutes of putting our thumbs out a city police car stopped and arrested us for vagrancy.

The cop, a young guy with an oversize mustache who was apologetic for the city’s policy, drove us to the desert a mile or so beyond the edge of town, where we hitchhiked standing by a distressing light-post covered with graffiti reading “39 hours without a ride,” “going on our third day,” and “anybody got any water?”

Vagrancy laws were so 20th century.

Today, the US Supreme Court will hear a case involving efforts by the City of Grants Pass, Oregon to keep homeless people off its streets and out of its parks and other public property. The city had tried a number of things when the problem began to explode in the last year of the Trump administration, as The Oregonian newspaper notes:

“They discussed putting them in their old jail, creating an unwanted list, posting signs at the city border or driving people out of town... Currently, officers patrol the city nearly every day, Johnson said, handing out [$295] citations to people who are camping or sleeping on public property or for having too many belongings with them.”

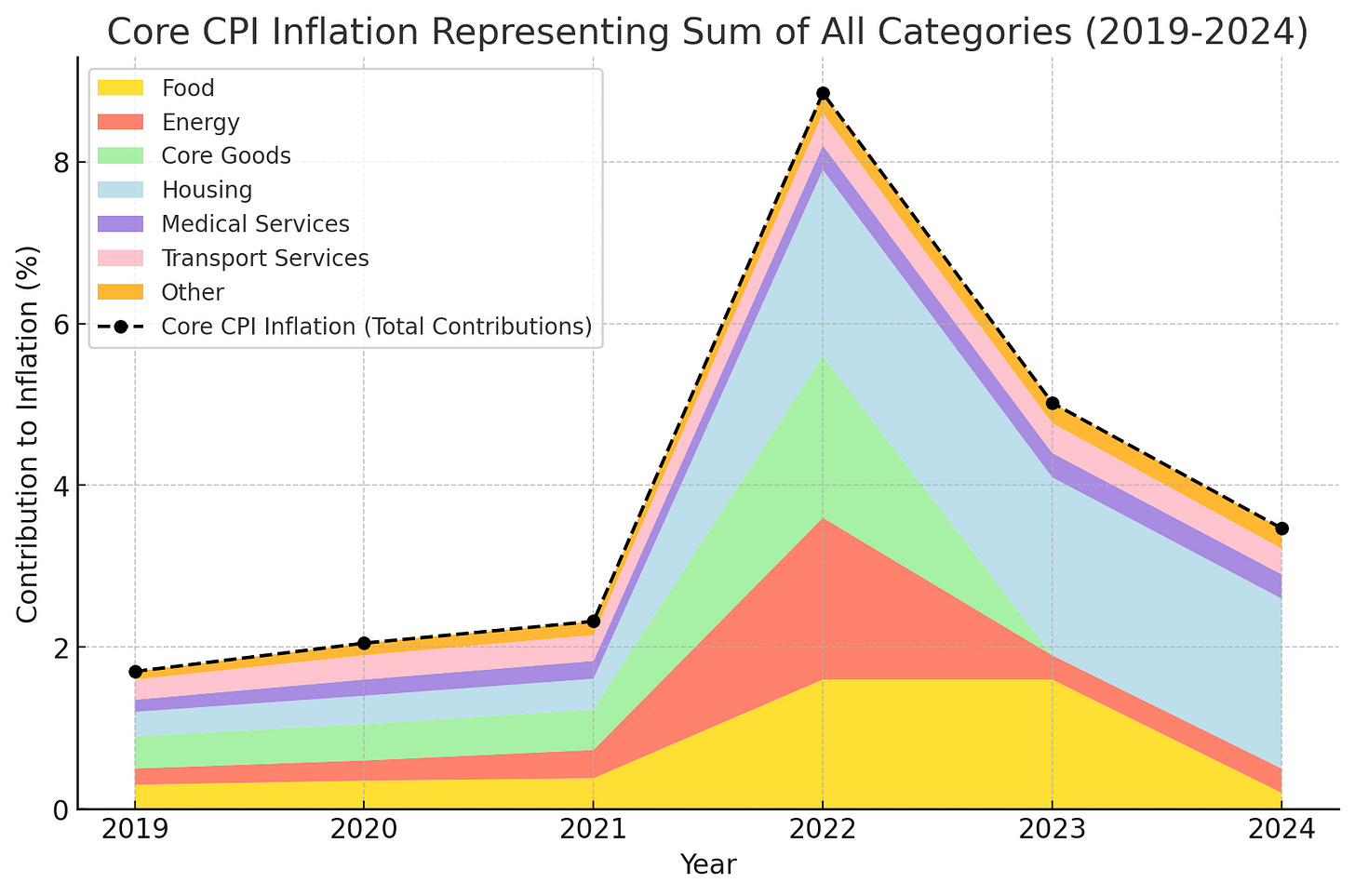

The explosion in housing costs have triggered two crises: homelessness and inflation. The former is harming the livability of our cities and towns, and the Fed’s reaction to the latter threatens an incumbency-destroying recession just as we head into what will almost certainly be the most important election in American history.

The problem with housing inflation is so severe today that without it the nation’s overall core CPI inflation rate would be in the neighborhood of Fed Chairman Jerome Powell’s 2 percent goal.

Both homelessness and today’s inflation are the result of America — unlike many other countries — allowing housing to become a commodity that can be traded and speculated in by financial markets and overseas investors.

Forty-three years into America’s Reaganomics experiment, homelessness has gone from a problem to a crisis. Rarely, though, do you hear that Wall Street — a prime beneficiary of Reagan’s deregulation campaign — is helping cause it.

Thirty-two percent seems to be the magic threshold, according to research funded by the real estate listing company Zillow. When neighborhoods hit rent rates in excess of 32 percent of neighborhood income, homelessness explodes.

And we’re seeing it play out right in front of us in cities across America because a handful of Wall Street billionaires want to make a killing.

It wasn’t always this way in America.

Housing prices have spun out of control since my dad bought his house in 1957 when I was six years old. He got a Veteran’s Administration-subsidized loan and picked up the brand-new 3-bedroom-1-bath ranch house my 3 brothers and I grew up in, in suburban south Lansing, Michigan. It cost him $13,000, which was about twice what he made every year working a good union job in a tool-and-die shop.

When my dad bought his home in the 1950s the median price of a single-family house was 2.2 times the median American family income. Today, the Fed says, the median house sells for $479,500 while the median American personal income is $41,000 — a ratio of more than ten-to-one between housing costs and annual income.

As the Zillow study notes:

“Across the country, the rent burden already exceeds the 32 percent [of median income] threshold in 100 of the 386 markets included in this analysis….”

And wherever housing prices become more than three times annual income, homelessness stalks like the grim reaper.

We’re told that America’s cities have seen this increase in housing costs since the 1950s in some part because of the growing wealth and population of this country. There were, after all, 168 million people in the US the year my dad bought his house; today there are 330 million.

And it’s true that we haven’t been building enough new housing, particularly low income housing, as 43 years of neoliberal Reaganomics have driven down wages and income for working class people relative to all of their expenses while stopping the construction of virtually any new subsidized low-income housing.

But that’s not the only, or even the main dynamic, driving housing prices into the stratosphere — and, as a consequence, the crisis in homelessness — over the past decade. You can thank speculation for much of that.

As the Zillow-funded study noted:

“This research demonstrates that the homeless population climbs faster when rent affordability — the share of income people spend on rent — crosses certain thresholds. In many areas beyond those thresholds, even modest rent increases can push thousands more Americans into homelessness.”

So how did we get here?

It started with a wave of foreign buyers over the past 30 years (particularly from China, Canada, Mexico, India and Colombia) who, in just the one single year of 2020, picked up over 154,000 homes as their way of parking money in America. Which is part of why there are over 20 times more empty houses in America than there are homeless people.

As Marketwatch noted in a 2015 article titled “The Danger of Foreign Buyers Gobbling Up American Homes”:

“Unusual high appreciation of the aforementioned urban centers is due to the ever growing influx of foreign buyers — mostly wealthy Chinese — who view American residential real estate as the safest investment commodity. … According to a National Realtors Association survey, the Chinese spent $22 billion on U.S. housing in 12 months through March 2014…. [Other foreign buyers primarily include] Canadians, British, Indians and Mexicans.”

But foreign investment has been down for the past few years; what’s taken over and is really driving home prices today are massive, multi-billion-dollar US-based funds that sweep into neighborhoods and buy everything available, bidding against families and driving up housing prices.

As noted in a Wall Street Journal article titled “Meet Your New Landlord: Wall Street,” in just one suburb (Spring Hill) of Nashville, “In all of Spring Hill, four firms … own nearly 700 houses … [which] amounts to about 5% of all the houses in town.”

This is the tiniest tip of the iceberg.

“On the first Tuesday of each month,” notes the Journal article about a similar phenomenon in Atlanta, investors “toted duffels stuffed with millions of dollars in cashier’s checks made out in various denominations so they wouldn’t have to interrupt their buying spree with trips to the bank…”

The same thing is happening in cities and suburbs all across America; the investment goliaths use finely-tuned computer algorithms to sniff out houses they can turn into rental properties, making over-market and unbeatable cash bids often within minutes of a house hitting the market.

After stripping neighborhoods of homes families can buy, they then begin raising rents as high as the market will bear.

In the Nashville suburb of Spring Hill, for example, the vice-mayor, Bruce Hull, told the Journal you used to be able to rent “a three bedroom, two bath house for $1,000 a month.” Today, the Journal notes:

“The average rent for 148 single-family homes in Spring Hill owned by the big four [Wall Street investor] landlords was about $1,773 a month…”

Ryan Dezember, in his book Underwater: How Our American Dream of Homeownership Became a Nightmare, describes the story of a family trying to buy a home in Phoenix. Every time they entered a bid, they were outbid instantly, the price rising over and over, until finally the family’s father threw in the towel.

“Jacobs was bewildered,” writes Dezember. “Who was this aggressive bidder?”

Turns out it was Blackstone Group, now the world’s largest real estate investor. At the time they were buying $150 million worth of American houses every week, trying to spend over $10 billion. And that’s just a drop in the overall bucket.

In 2018, corporations bought 1 out of every 10 homes sold in America, according to Dezember, noting that, “Between 2006 and 2016, when the home ownership rate fell to its lowest level in fifty years, the number of renters grew by about a quarter.”

This all really took off around a decade ago, when Morgan Stanley published a 2011 report titled “The Rentership Society,” arguing that — in the wake of the 2008 Bush Housing Crash — snapping up houses and renting them back to people who otherwise would have wanted to buy them could be the newest and hottest investment opportunity for Wall Street’s billionaires and their funds.

Turns out, Morgan Stanley was right. Warren Buffett, KKR, and The Carlyle Group have all jumped into residential real estate, along with hundreds of smaller investment groups, and the National Home Rental Council has emerged as the industry’s premiere lobbying group, working to block rent control legislation and other efforts to regulate the industry.

As John Husing, the owner of Economics and Politics Inc., told The Tennessean newspaper:

“What you have are neighborhoods that are essentially unregulated apartment houses. It could be disastrous for the city.”

Meanwhile, as unionization levels here remain among the lowest in the developed world, Reagan’s ongoing war on working people continues to wipe out America’s families.

At the same time that housing prices, both to purchase and to rent, are being driven through the roof by foreign and Wall Street investors, a survey published by NPR, the Robert Wood Johnson Foundation, and the Harvard TH Chan School of Public Health found that American families are in crisis.

— “Thirty-eight percent (38%) of [all] households across the nation report facing serious financial problems in the previous few months.

— “There is a sharp income divide in serious financial problems, as 59% of those with annual incomes below $50,000 report facing serious financial problems in the past few months, compared with 18% of households with annual incomes of $50,000 or more.

— “These serious financial problems are cited despite 67% of households reporting that in the past few months, they have received financial assistance from the government.

— “Another significant problem for many U.S. households is losing their savings during the COVID-19 outbreak. Nineteen percent (19%) of U.S. households report losing all of their savings during the COVID-19 outbreak and not currently having any savings to fall back on.

— “At the time the Centers for Disease Control and Prevention’s (CDC) eviction ban expired, 27% of renters nationally reported serious problems paying their rent in the past few months.”

These are not separate issues, and they are driving an explosion in homelessness.

The Zillow study found similarly damning data:

— “Communities where people spend more than 32 percent of their income on rent can expect a more rapid increase in homelessness.

— “Income growth has not kept pace with rents, leading to an affordability crunch with cascading effects that, for people on the bottom economic rung, increases the risk of homelessness.

— “The areas that are most vulnerable to rising rents, unaffordability, and poverty hold 15 percent of the U.S. population — and 47 percent of people experiencing homelessness.”

The Zillow study makes grim reading and is worth checking out. In community after community, when rent prices exceed 32 percent of median household income, homeless exploded. It’s measurable, predictable, and is destroying what’s left of the American working class, particularly minorities.

The loss of affordable homes also locks otherwise middle class families out of the traditional way wealth is accumulated — through home ownership: over 61% of all American middle-income family wealth is their home’s equity. And as families are priced out of ownership and forced to rent, they become more vulnerable to long-term economic struggles and homelessness.

Housing is one of the primary essentials of life. Nobody in America should be without it, and for society to work, housing costs must track incomes in a way that makes housing both available and affordable. This requires government intervention in the so-called “free market.”

— Last year, Canada banned most foreign buyers from buying residential property as a way of controlling their housing inflation.

— New Zealand similarly passed their no-foreigners law (except for Singaporeans and Australians) in 2018.

— Thailand requires a minimum investment of $1.2 million and the equivalent of a green card.

— Greece bans most non-EU citizens from buying real estate in most of the country.

— To buy residential housing in Denmark, it must be your primary residence and you must have lived in the country for at least 5 years.

— Vietnam, Austria, Hungary, and Cyprus also heavily restrict who can buy residential property, where, and under what terms.

This isn’t rocket science; the problem could be easily fixed by Congress if there was a genuine willingness to protect our real estate market from the vultures who’ve been circling it for years.

Unfortunately, when Clarence Thomas was the deciding vote to allow billionaires and hedge funds to legally bribe members of Congress in Citizens United, he and his four fellow Republicans opened the floodgates to “contributions” and “gifts” from foreign and Wall Street interests to pay off legislators to ignore the problem.

Because there’s no lobbying group for the interests of average homeowners or the homeless, it’s up to us to raise hell with our elected officials. The number for the Congressional switchboard is 202-224-3121.

If ever there was a time to solve to this problem — and regulate corporate and foreign investment in American single-family housing — it’s now.

I have read your column only a few months and became a subscriber over the last few weeks. You do an exceptional job of writing timely, well researched, and compelling pieces.

Thankyou.

Thanks, Thom, for yet another well researched and incisive piece of investigative journalism, sadly missing from the rest of the MSM. I would include the Trump administration's $2T tax break giveaway to his wealthy friends and Trump's intimidation of Jerome Powell to keep Fed interest rates at near zero for far longer than otherwise indicated, which drove up the prices of houses that folks could afford and inflated the entire housing market.